What is Stamp Duty? How is stamp duty calculated in MMR?

There are several taxes that a homebuyer has to pay while purchasing a home. Stamp duty is one of the most significant ones that homebuyers pay while purchasing a property. A homebuyer is considered the legal owner of the property only after the receipt of stamp duty payment. Since the stamp duty charges are over and above the property costs, it often plays a role in influencing purchasing decisions. According to World Bank’s doing business dataset, Indian cities have higher stamp duty rates than most of the cities in the world. This makes stamp duty charges more important for homebuyers.

Maharashtra stamp duty charges

As per the Maharashtra Stamp Duty Act, 1958 property buyers in MMR have to pay stamp duty and registration charges on all types of properties, including residential, commercial, whether freehold or leasehold. Stamp duty in the state is calculated basis the higher value between the ready reckoner rate and agreement value, mentioned at the time of buying a property. Further, registration charges in Mumbai are 1% for properties below INR 30 lakhs and INR 30,000 for all properties above INR 30 lakhs.

After the pandemic hit in 2020, lockdowns led to property registrations halving YoY during Jan-Sep 2020 in Mumbai region. To provide a boost to the ailing sector, the government of Maharashtra, announced a time-bound reduction in the stamp duty rates on property purchase. Against the 5% stamp duty being charged earlier, the government slashed the stamp duty to 2%, for the period of September 1, 2020 to December 31, 2020. Further, during the period of January 1, 2021 to March 31, 2021, the stamp duty was reduced by 2%. The homebuyers were charged 3% stamp duty during this period. Post March 31, 2021, the stamp duty rates were reset to 5% for homebuyers.

Stamp duty reduction in MMR

Period | Prior to September 1, 2020 | September 1, 2020 to December 31, 2020 | January 1, 2021 to March 31, 2021 | Rates after March 31, 2021 |

Stamp duty rate | 5% | 2% | 3% | 5% |

Source: Government of Maharashtra

Case: Impact of stamp duty deduction in MMR on an individual

An individual who is willing to buy a property with an agreement value of say, INR 70 Lakhs (considering this value is higher than the prevailing ready reckoner rates), would be paying a stamp duty of INR 140,000 between September 1, 2020 to December 31, 2021 and INR 210,000 between January 1, 2021 and March 31, 2021, considering the temporary benefit that was provided by the government. Post March 31, 2021, the same individual would be paying stamp duty of INR 350,000 for purchasing property. For an individual, the amount of stamp duty to be paid, almost doubles without the relaxation.

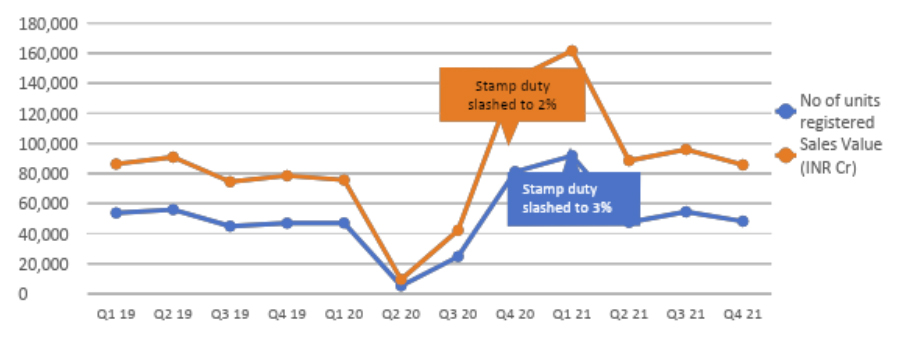

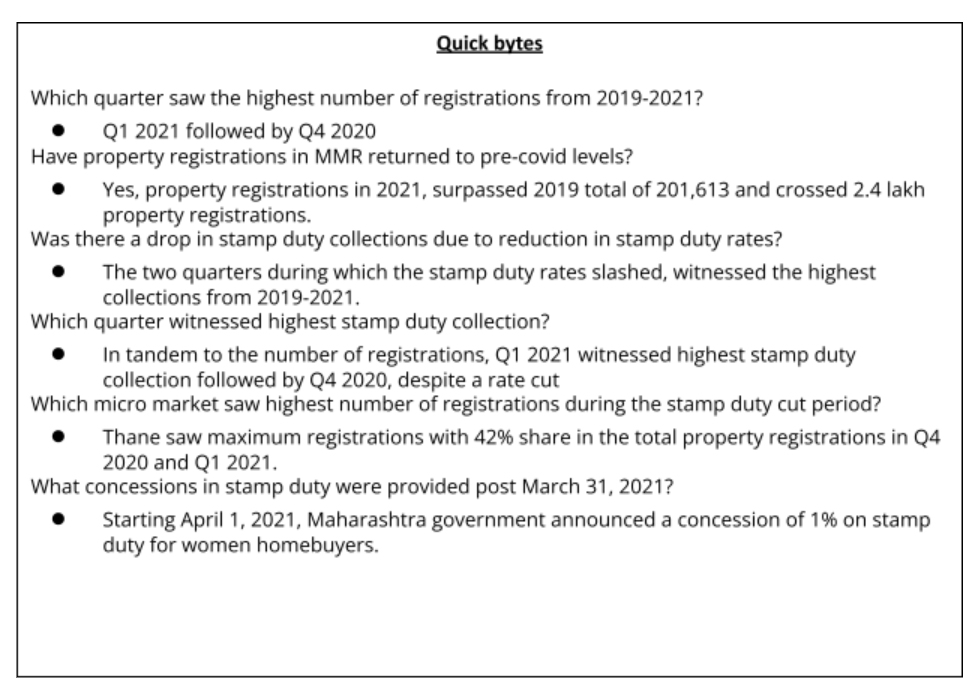

Property registrations witnessed an uptick due to reduction in stamp duty

The reduction in stamp duty charges led to an immediate increase in property registrations in MMR. For instance, led by the reduction effective from September 2020, the last quarter of 2020 witnessed huge recovery in property registrations. The continuation of benefit for the stamp duty reduction in Q1 2021, led to sustained growth and provided momentum for sales during the Jan-march quarter. Q4 2020 and Q1 2021 accounted for 51% and 38% of the property registration for 2020 and 2021 respectively. Overall, Q1 2021 saw the highest quarterly registrations in three years (2019-2021) in MMR. With waning of the second wave, increase in number of vaccinations and primarily due to reduction in stamp duty rates, the number of registrations crossed 90,000 in Q1 2021.

Demand jumps with a cut in stamp duty

Source: CRE Matrix, Colliers

Thane and Central Mumbai saw heightened activity due to reduced stamp duty

With reduction in stamp duty rates, Central Mumbai saw the maximum revival in sales in 2021. Registrations in the micro market consisting of areas like Parel, Dadar, Prabhadevi, Wadala, rose 93% from 2019 and 71% from 2020. Central Mumbai accounted for 77% share in sales in the luxury segment in 2021. Overall, in MMR, Thane accounted for the highest number of registrations with 42% share, and highest stamp duty collection.

Surge in demand for affordable and luxury housing

A cut in stamp duty rate gave fillip to affordable and mid segment (<INR 1 crore). Property registrations in the affordable segment rose 22% in 2021, over 2019. There was a clear preference for units priced below INR 1 crore in Thane, which accounted for the highest sales in affordable segment with 46% share in sales. The demand in luxury segment bounced back after several years. Sales in the luxury segment (>INR 3 crore) almost doubled in 2021, compared to 2019, accounting for the highest share in three years. Central Mumbai followed by Western suburbs accounted for the highest sales in the luxury segment. The two micro markets together accounted for 60% sales in the luxury segment.

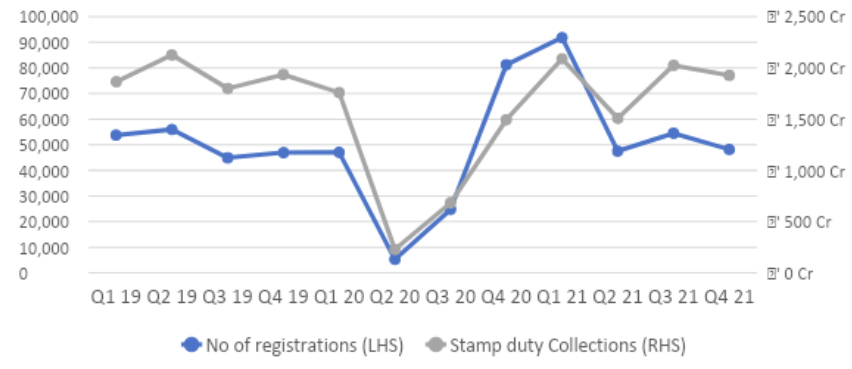

Lower stamp duty charges, but higher collections for the exchequer

Source: CRE Matrix, Colliers

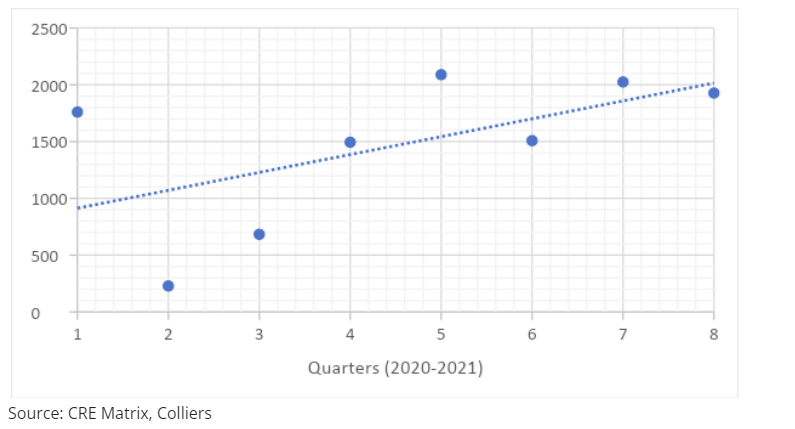

With increase in number of registrations, the stamp duty collections also increased in tandem. Despite a cut in stamp duty charges for the period of September 2020 to March 2021, the government’s stamp duty collections rose as the increased sales volumes more than offset the expected dip in revenues due to reduction in stamp duty rate. The trigger in home sales in 2021 led to 81% higher stamp duty collections compared to 2020, almost touching 2019 levels. Further, the increase in collections were not only driven by the increased volumes of property registrations steered by the rate cut, but other factors such as low home loan rates, largely stable prices, and the inclination to own homes due to the pandemic.

Stamp duty collection dipped soon after the rates were reset

Way Forward

The market conditions are gradually improving, but MMR continues to see substantial unsold inventory. For perspective, the unsold inventory at the end of December 2021 was just 1% lower from that of 2020. Despite a spurt in property registrations led by stamp duty cuts and other concessions, unsold inventory still stands higher than pre-covid levels. This underscores the importance of continuous short-term relief measures that can keep market sentiments positive.

While the concerns related to Covid-19 continue to prevail, stamp duty cuts can act as booster for homebuyers and fence sitters. A time-bound extension in stamp duty cuts, could help the realty sector gain momentum and help recover faster. Moreover, in the absence of the specific demand-side interventions from the Budget 2022-23, it would be timely to continue the reduction in stamp duty charges as prospective homebuyers can get a combined benefit supported by the lower home loan interest rates as the repo rates continue to remain stable.